I. Objective.

The objective of this policy is to guide the advisors who are part of the ALGO GLOBAL team, so that they can conduct themselves correctly in the contract renewal processes. And that they also have clarity in the commissions that correspond to them with respect to said renewals.

II. Area of application.

This policy applies to all advisors who are part of the ALGO GLOBAL team, including: Referrer, IB, junior promoter, senior promoter, expert promoter, independent promoter, promotion leader, directors, and among other related parties.

III. Commission for contract renewal.

1.- Commission for renewal of contracts: In order for the promoter to be a candidate for the payment of commission for renewal, it will be mandatory that, prior to the contractual expiration, each client with a period close to expiration signs a new contract. This with the following objective:

a) Strengthen the relationship with each client annually, clarifying at the time of signing the new contract, what part of the amount of your balance sheet you wish to renew and in which portfolio you wish to invest (initial capital, subsequent contributions and generated returns) . This in order to improve care and follow-up. In addition to generating greater vertical growth in the client portfolio, which translates into greater capital retention.

b) Renew the investment contract or contracts that are about to expire, updating relevant information such as: Amount, portfolio, demographic data, KYC, among others; It is important to have the latest or most updated version of the contract.

IV Commission for obtaining renewals:

1.- It is important to highlight that the change in this policy seeks to update the client and contract information.

Based on this assumption, if the promoter did not take prior precautions to do the work of signing the new contract, and it is updated automatically, the promoter WILL NOT BE A CANDIDATE TO OBTAIN COMMISSION FOR CAPTURE, AND THIS IS IRREVERSIBLE. If the promoter in question is in this case, he will only be entitled to a 1% commission for raising the investment to be renewed (the commission for raising the investment in any of its cases does not apply to the liquidity portfolio).

The contract will be renewed automatically if the client does not give notice 30 calendar days prior to the expiration of his wish to cancel, and the promoter who did not take any action to sell or retain the client and portfolio will not be considered for payment. for contract renewal. The way to corroborate this is by requesting the renewal of the contract or contracts of your client or clients, requesting its update to the email [email protected] . If there is no evidence of renewal actions being exercised, it is made clear that there was no sales work in this interval of the 30 days prior to expiration, so automatic renewal is carried out as stipulated in the content of the contract.

2.- In the event that the renewal occurs automatically, the renewal of the contract will be for a period of 12 months taking the total balance sheet (initial capital, subsequent contributions and generated returns) as indicated in the clauses of the contract previously. signed, the investment will run in the same portfolio previously contracted (Does not apply to liquidity portfolio). THIS POLICY IS IRREVERSIBLE, so you are invited to always be up to date with your contract renewal procedures. To do this, you can contact the BackOffice area, mainly with the first module, which is contract generation, to request a detailed list of the contract expirations of the month.

This, considering the BackOffice standards and policies they have in relation to Client Protection, so it will run in the same portfolio previously contracted (It does not apply to the liquidity portfolio). THIS POLICY IS IRREVERSIBLE. Therefore, advisors are invited to always be up to date with their contract renewal procedures. As such, you can rely on the BackOffice area, specifically with the first module, which is: Contract Generation, to request a detailed list of contract expirations.

V Criterion to establish the commission for attracting contract renewals:

This will be calculated in the same way as the commission for attracting new investments is currently calculated. That is, it is calculated considering the commercial range of the value of your current portfolio for the period. For the respective payment of acquisition commission and renewal commission, the same calendar payment days that the BackOffice department currently contemplates will prevail.

VI Subsequent contributions:

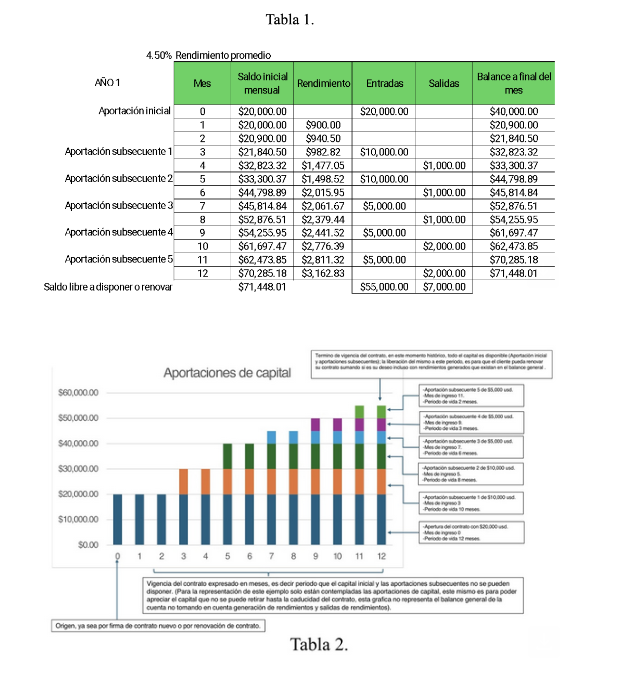

1.- Subsequent contributions are those that are generated after signing the contract. IT SHOULD BE NOTED THAT EACH SUBSEQUENT CONTRIBUTION THAT BELONGS TO THE SAME ACCOUNT NUMBER (ASSIGNED IN MT5) WILL BE CALCULATED PROPORTIONALLY BASED ON THE MONTHS REMAINING TO EXPIRE AFTER THE SIGNING OF THE CONTRACT. Below are the following examples:

2.- Each subsequent contribution has a life period proportional to the months remaining to expire in your contract.

Understanding the dynamics that each account number has an initial contribution, subsequent contributions, generation of returns and possible outputs of returns, the general balance of each account at the end of its validity period is multifactorial.

Therefore, if subsequent contributions do not expire at the same time as the contract expires, each additional contribution would have to be calculated at the historical moment of its renewal taking into account the history of its balance sheet.

In this sense, the capital to be renewed must be defined, plus the proportional sum of the accumulated returns after the renewal of the contract. This causes the BackOffice department to generate a fairly elaborate calculation to establish with what amount each additional contribution must be signed, since the movement of accounts by its nature is dynamic, which makes the calculation complex. Situation that ends up hindering the linear nature of the process.

By taking the initial contract date as a reference, to release both the initial capital, as well as the subsequent contributions and the accumulated returns on the date established for the renewal of the contract, the client can decide how much they wish to renew their new contract, and in what portfolio wants to contract its investment. This restarts the process, as shown in “Table 1” in the previous point.

3.- The client can make the amount of subsequent contributions that he feels necessary, without any restriction, only these will have a life proportional to the date of the contract and these cannot be drawn down until the expiration of the contract (does not apply to the liquidity portfolio). .

4.- If the client, in accordance with his interests, wishes to maintain the subsequent contribution for a period of 12 months, it is necessary to generate a new contract, with a new account number in MT5. Likewise, you must decide the portfolio with which you will contract your investment (conservative, moderate or aggressive portfolios). Under this logic, the promoter WILL charge 100% of the recruitment commission, since it is a new contract.

5.- If the client, in accordance with his interests, wishes NOT to maintain the subsequent contribution for a period of 12 months and does not wish for said contribution to be part of the original contract, it is necessary to generate a new contract, with a new account number in MT5 and contract a liquidity portfolio. In this way, said investment is available with open liquidity. Therefore, it will not generate a recruitment commission for the promoter.

VII Commission on subsequent contributions:

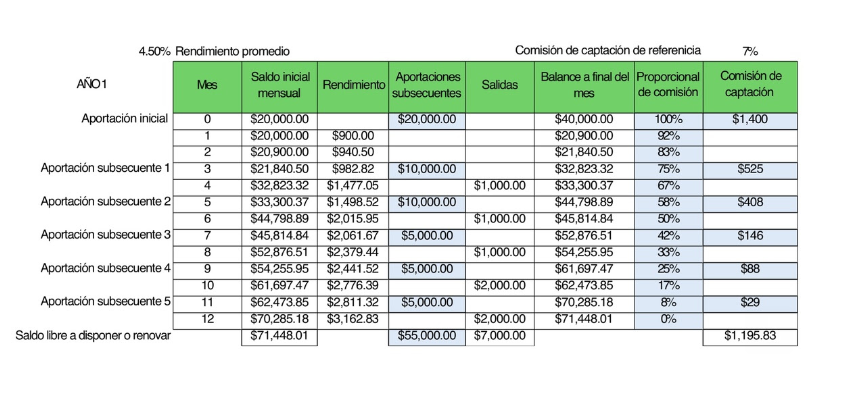

1.- An additional capital contribution to the original contract belongs to the same account number, which is referenced in the contract. Each subsequent contribution that enters the balance sheet of the same account will form part of its capital. Therefore, it is subject to the expiration of the original contract (reference “Table 2”).

In this order of ideas, it cannot be disposed of until it expires, and subsequent contributions are subject to payment of a deposit commission and will be calculated by the proportional part of the months remaining to expire of the original contract. This factor will be multiplied by the commercial range commission table, and this will result in the acquisition commission generated by subsequent capital contribution. Below is the respective example:

| 2.- The contribution or subsequent contributions that emanate from the original contract will be considered raising new capital. Therefore, this will be subject to the date of payment of the deposit commission, and will be payable on the dates designated for this by the BackOffice department. 3.- As there is one or more subsequent contributions, it will not be necessary to sign annexes to the contract. , since it will be enough to show the increase request by sending an email to [email protected] , and attaching the deposit slip, it being important to make reference to the account number that is intended to be funded. This mechanism will be adopted with the objective of simplifying the operation commercial and not harm the relationship with the client by making him sign one or more annexes. It should be noted that what provides security to this practice is that there is a prior contract and an account number affiliated with it. Once the validity of this has ended, it leaves open the possibility of releasing the total balance sheet of the same client. VII Applicable programs. 1.- Contract renewals WILL NOT BE considered for the following programs: Promotion leader, referral program and program of loyalty, since this commercial strategy is considered for capital retention, but not capital raising. However, promotion leader, referral program, and loyalty program will benefit from the commission of returns generated by contract renewals. 2.- For the calculation of MILES STONES, only subsequent new contributions will be taken into account. Contract renewals do not apply to the calculation of the same program since this is calculated based on the quarterly increase in capital, considering the promoter's current portfolio.IX Liquidity portfolio:1.- The liquidity portfolio is a product that was created so that the client can obtain the benefit of open liquidity. Therefore, if the client wishes not to maintain the capital or a subsequent contribution over a period of time, consider this as the best option. 2.- It is very common that when a client ends their contractual term, they wish to maintain their capital with a product that does not protect your capital in the long term, and the liquidity portfolio may be the best option for this. In these cases, the advisor will not be a candidate for a deposit commission. 3.- If the client is in the liquidity portfolio, in which he can have open liquidity, and due to the advisor's expertise, he manages to migrate the capital to a conservative, moderate or aggressive portfolio, the acquisition commission will be considered. Being a benefit for ALGO GLOBAL, since this capital will remain for at least twelve months.4.- In accordance with the previously mentioned case, the advisor will benefit from the commission for fundraising, and this will be paid on the calendar days designated for this purpose. .5.- When migrating a liquidity portfolio to a conservative, moderate or aggressive portfolio, and there is the assumption of subsequent contributions after signing the original contract, this or these are subject to the rules established in Chapter VI of this document. communication, which establishes that said capital contributions cannot be made available until the validity of the original contract ends, being subject to the account number MT5.6.- When migrating a liquidity portfolio to a portfolio that is either conservative, moderate or aggressive, and there is the assumption of subsequent contributions, after the signing of the original contract, the fundraising commissions will be subject to the rules established in chapter VII of this statement. Reiterating that the commissions will be calculated proportionally to the months that the contract is valid at the time of depositing said subsequent contribution of capital.7.- In the event that a client wishes to migrate from a liquidity portfolio to a conservative, moderate or aggressive, the recruitment commission for the promoter will be considered, but it will NOT be considered for the calculation of the recruitment commission for the promotion leader and neither will the loyalty program or referral program apply, since it is considered as a customer retention strategy. capital, but not a strategy to attract new clients. The benefits for the promotion leader, loyalty program and referral program will apply to the payment of performance commission.8.- In the event that a client wishes to migrate from a liquidity portfolio to a conservative, moderate or aggressive portfolio, they will only be subsequent new contributions taken into account for the calculation of THOUSANDS STONES. The conversion of a liquidity portfolio to a conservative, moderate or aggressive portfolio does not apply to the calculation of the same program since this is calculated based on the quarterly capital increase of the promoter's current portfolio.X Irregular contracts.1.- At the moment Upon entering the funding request for a new account in ALGO GLOBAL, the promoter must properly fill out the contract in relation to the investment portfolio. In the event that said contract is found to have errors or even lacks information, BackOffice will ask you to sign this document again, and the promoter will be obliged to cover said request as soon as possible. Under the assumption of the previous paragraph, BackOffice has The Client Protection policy mentions that the client's investment will be redirected to the MT5 FIAT Account (MetaTrader 5). Once the promoter has regularized and complied with the requirements requested by BackOffice, the client's investment will be assigned to the requested portfolio (which may be conservative, moderate, aggressive, liquidity). If the aforementioned assumptions occur, THERE CAN BE NO EXCEPTIONS FOR THE CALCULATION OF RETROACTIVE COMMISSIONS, EITHER BY CAPITATION COMMISSION, OR BY PERFORMANCE COMMISSION. That is, in order for ALGO GLOBAL to be able to consider a commission calculation, it will be taken into consideration that the contract with the client has been executed correspondingly, whether for initial investment or contract renewals.2.- Likewise, it is reported that, In the event that the Back Office area detects irregularities, the client's investment will remain in the MT5 FIAT ACCOUNT until ALGO GLOBAL can learn of their manifest desire for the portfolio that best suits the client with their respective contract.3.- In the In the event of contract renewal, and the client has an open balance sheet (initial capital, subsequent contributions and accumulated returns), it is mandatory that the promoter induce his client to renew the amount available in his balance sheet. Likewise, you must also contract the portfolio or portfolios that best suit the client, in accordance with their profile and asset strategy. The capital of the general balance that is not renewed CANNOT REMAIN IN ANY PORTFOLIO, since the client protection policy applies. . The remainder of the balance sheet that is not considered in the contract renewal will be transferred to the client's MT5 FIAT account. Said balance will remain this way until the client decides whether to renew their contract or withdraw their capital. UNDER THIS ASSUMPTION, THERE WILL BE NO EXCEPTIONS OR RETROATIVE CALCULATIONS, avoiding falling into cases where there is no contract that supports each investment, whether new or renewal. .XI Payment dates. The calendar dates designated by the Backoffice department are not altered in any way, respecting the dates established for each payment, whether initial deposit, performance or something related. XII Contracts with subsequent contributions subject to 12 months from February 1, 2024 to June 1, 2024. The last modification of the client contract that came into force was in February of this year. This modification emphasizes the fact that each subsequent contribution would have a life of twelve months regardless of whether it belongs to the same account number in MT5. Therefore, subsequent contributions that were paid one hundred percent by deposit commission since it entered In force of this communication, THE CAPITAL OF THESE CONTRIBUTIONS WILL NOT BE WITHDRAWABLE UNTIL THEIR VALIDITY PERIOD OF 12 MONTHS HAS COMPLETED. Justification for the case: After carrying out rigorous studies, operational analyzes and tests in financial runs by both the operations department, the commercial, the BackOffice department, and the general management conclude the following: Subjecting twelve months to subsequent contributions entails logistical conflicts and calculations at an operational level in general. In this virtue, it is repealed that subsequent contributions must comply with a term of twelve months, and from the entry into force of this policy, subsequent contributions will have the same validity as the client's contract. |

| .----This policy will come into force as of June 1, two thousand twenty-four---- |

| Sincerely, |

| General Directorate Something Global |